Many experts say that buying a home where you live rent-free is not an investment.

Well, it is.

The fact that Robert Kiyosaki tells that home is not a real estate investment doesn’t make it true.

Bad debt is debt that makes you poorer. I count the mortgage on my home as bad debt, because I’m the one paying on it. ~ Robert Kiyosaki

I’m amazed that a person who has written tons of books about real estate investment can say something so stupid.

Here’s why…

If you are putting your money in an index fund, then you’re also “the one paying on it.”

Doh!

It’s not “making you poorer,” you idiot, you are paying yourself!

The idea goes something like this:

If it doesn’t put money in your pocket, then it’s not an investment.

Yes, it is!

Update: The Corona crisis

The global coronavirus pandemic does not change the points I have made in this post. You may even be in a very good position to buy a home in the wake of the economic downturn.

If you bought your home at the peak, don’t worry it will get back up, eventually.

Do you want to survive the economic crisis and come out from the other side as strong as possible? Here are the steps I used in the last downturn and follow now.

Homeowners have a higher net worth!

People who own homes have a lot higher net worth than people who rent. The difference is so massive that you could say that these people are from different countries.

There is a reason so many Americans develop their net worth through homeownership: It is a proven wealth builder and savings compeller. The average homeowner boasts a net worth ($195,400) that is 36 times that of the average renter ($5,400). ~ The New York Times Magazine

And it’s the same all over the world. Estonian researchers compared homeowners to the renters and saw that the average net worth was more than 30 times in favor of the owners.

The average renter had a net worth of 2000 euros, and the average homeowner had a net worth of 64 thousand euros.

Think about that for a second.

One group was broke, while the other group had a net worth that exceeded the national annual income over 5 times.

Start investing in your home.

Here’s the why and how.

If you buy something that appreciates, then you don’t have to get monthly payments for it to be an investment. There are two ways you can invest in appreciating assets:

1. You buy something that goes up in value.

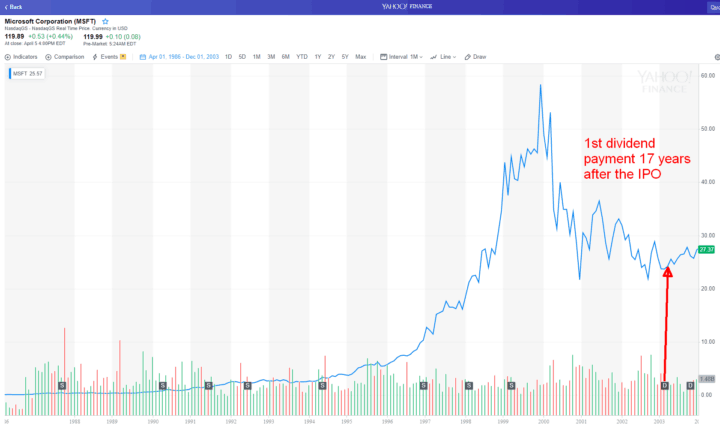

For example, if you bought Microsoft stock (MSFT) when they had an IPO, then you would not get dividends for 17 years. Not getting a monthly income doesn’t mean that it wasn’t an investment.

During those 17 years, your money would have grown to over 480 times your initial investment in December 1999. Or 200 times by the first dividend payment. Amazon has not paid dividends at all in over 20 years since the IPO. So, according to Kiyosaki, it’s not an investment. Here are current AI stocks that are in growth model

2. You buy something that saves you money.

Here’s your home as an investment example; when you buy a house, then you have loan payments. These payments may seem like rent. Except that when you pay for the home, you are buying it. Sure, part of the mortgage payment is interest. However, with every payment you put some of that money in the bank called your home.

Now, when you look at the two options, you may realize that your home is both. It appreciates over time, and you save on the rent.

Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. ~ Franklin D. Roosevelt

So, let’s calculate, is buying a house a good investment?

The calculation for a home as an investment

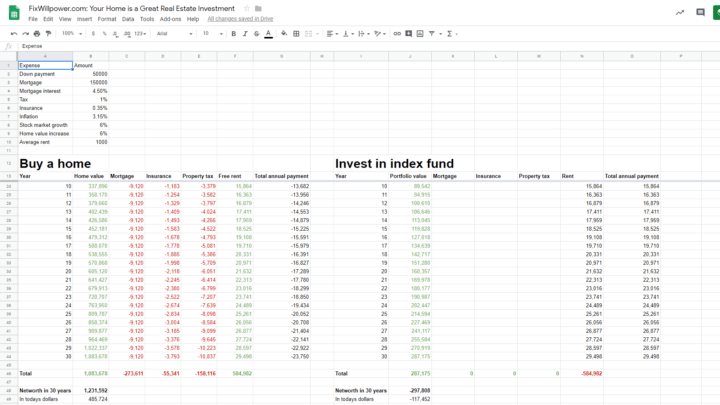

1. The median price for a home in the United States is 200 thousand dollars. Let’s assume that you are a reasonable person and need nothing more than average.

2. In early 2019, the average interest rate on a 30-year mortgage is 4.5%. It’s fixed interest, and you can use that for calculating all the payments you have to make down the road.

3. Let’s say that you make a down payment of 50 thousand dollars or 25%. Keep in mind that it is possible to make a down payment as low as 5%. With a lower down payment, you just take out a bigger loan, and your monthly payments are larger.

4. You need insurance for your mortgaged home. The average insurance is 3.5 dollars for every 1000 dollars of home value. In this example, this means you have to pay 200 times 3.5 or 700 dollars per year.

5. Property taxes range from 0.18% in Louisiana to 1.89 percent in New Jersey. (source) I use 1% as an average in my calculation.

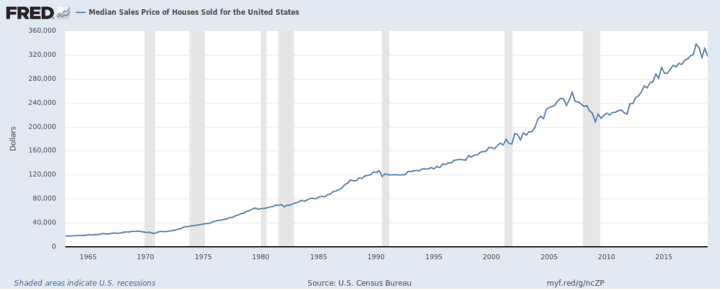

6. The average increase in the price of real estate is 6%. (source)

7. Since 1913 the average annual inflation rate has been 3.15% per year. (source)

Now let’s add all this together:

$150,000 total principal

$60,000 total tax

$21,000 total home insurance

$123,610 total interest

$354,610 total of 360 payments

Loan pay-off date March 2049 and your expenses for buying your home are 985 dollars per month.

After 30 years, you will have a home valued at 1,231,592 dollars, plus you have saved 584,982 dollars on rent.

Owning a home is a keystone of wealth… both financial affluence and emotional security. ~ Suze Orman

A comparable investment in an index fund

If you would not buy that home, you would have 50 thousand dollars that you can put in a low-cost index fund. Let’s see how this works out.

You put 50 thousand dollars in a fund that makes approximately 6% per year. By the end of the thirtieth year, you will have 287,175 dollars.

The upside is that you don’t have to make any additional payments in the fund. The money just keeps growing. However, you have a lot less money than you would have if you had invested it in your home.

Some people may say that you can make regular payments every month after that, but you can’t. You spend that money on your rent. Assuming you are not living under a tree.

And that is it!

You make the same payments every month that your home-buying friend does. But your rent payments will not increase your net worth.

It would be safe to assume that the rent payments are in the same range as the mortgage payments plus expenses. So you may end up paying more per month and not keeping any of it.

You can find the rough calculation of both scenarios in the Google Sheets here.

Here’s another take on buying a home vs renting. These numbers are more in favor of renting, but buying still comes out on top. Following video answers the question if you should buy a house or invest.

The upside of a home as an investment

Real estate provides some protection against inflation.

Real estate prices will always go up!

Yeah!

I know!

That’s what they said in 2007 and 2008.

If you don’t believe me look at prices at the peak of 2007 rally and 2019. Sure the inflation-adjusted price might not be there yet, but it will continue to go up.

In economic downturn, you are much more likely to work your ass off to keep your home than to save your stock portfolio.

Real estate’s value rarely drops to zero, and you have to insure it against that eventuality.

Diversification of your assets. Investing in real estate is a good bet. It’s safe and inflation-proof, and you can live in it.

Your home is part of your emergency fund if everything else fails.

Of course, there are also the cons to investing in your home.

You have a huge advantage if you treat your home as an investment.

The person to whom you are renting your real estate is going to be extra careful to keep the value of the property high.

I have had tenants who have done serious damage to my rental property. I mean holes in the wall type of damage. Hopefully, you will not encounter tenants like that. But even the best tenant cares less about your property than you would.

So, “renting” your only property to yourself has another upside compared to renting to other people.

Low intrest loan. Having a mortgage will also give you another source of low-interest finances when you have an emergency. But not in crash.

The downside of a home as an investment

Now that we have cleared all this out, there are aspects of a mortgage that may make it less attractive for some people.

Many people may not qualify for a mortgage even if they have money for a down payment. Technically it’s not the downside of investing in a home, but there it is.

Real estate can lose value

If you make a mistake of buying your home in a neighborhood where prices go down, then there’s almost nothing you can do. You have to sell and cut the losses.

Real estate ties you down and gives your roots

You will be much less likely to accept opportunities that involve you selling your home and moving to another location. Often you will even not consider such options as opportunities.

Economic down turn

A home loan is a significant risk when the economy collapses.

When you lose all your income and cannot make the payments on your mortgage, then you risk losing your home. The bank will sell your home at a discount, and you may not get back the money you have put in. However, in most cases, you can get something back.

Loan interest

You pay interest on your mortgage. In my example, for the loan of 30 years, I have to pay 82.4% of the original value as interest. Interest payments mean that in today’s money you pay 162% for your home.

Maintanence and worry

Amortization of your real estate acts as a counterbalance to the inflation proofing aspect of your home. From the inflation perspective, your house value increases year by year. Living in your home decreases its value as it wears down. You should budget about 1% per year for maintenance.

Mental load and responsibility of fixing things and regularly renovating to keep the value your real estate up. If you live in a rental, you don’t have to think about these things, and this makes your life easier.

You have other expenses. Insuring your mortgaged home is mandatory.

Insurance payments make your monthly payments larger. The silver lining is that when something happens to your home it’s value will not go to zero. Alternatively, if the value goes to zero, you get your money back from insurance.

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes, buy a third. And, lend your relatives the money to buy a home. ~ John Paulson

The risk of using your home as an investment

Some people who don’t consider your home an investment say something like this:

When the economy tanks you have to keep paying the mortgage payments because you have to live somewhere. So, you must make a fixed payment every month because you need to live somewhere.

And this is the key!

You have to live somewhere!

If you live in your home you pay a mortgage. From every payment the interest goes to the bank, and the rest goes directly to your net worth.

It may shock you, but living in a rental is not free.

The important point here is that the rental price of a property is higher than the mortgage payment on the same property. Sometimes, it may be higher than the mortgage. It depends on the rental market and interest rates. However, some of the mortgage payment is the money you put in your home.

You lose all the rent you pay!

Let’s say that you get to the point where you cannot make the monthly payments.

Your landlord would evict you and your banker would foreclose your mortgage. In both cases, there’s always room for negotiation (read this book to learn to negotiate).

Your landlord would evict you and your banker would foreclose your mortgage. In both cases, there’s always room for negotiation (read this book to learn to negotiate).

Renting gives you two options.

- You can walk away from your rental and maybe find something more affordable.

- Another option is to move in with your mother.

Owning your home gives you more options.

- You can rent out your home and move to a cheaper rental.

- Rent out a part of your home and still live in it.

- Sell your home, pay the bank, and still have something left.

And then there’s the third option of living under the bridge in both cases.

He is not a full man who does not own a piece of land. ~ Hebrew Proverb

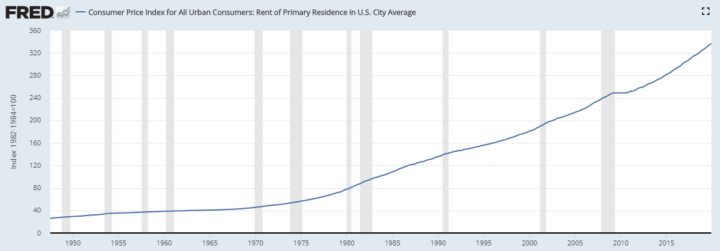

Rents don’t drop in a recession

Another important aspect to consider is, what happens to rents in a downturn.

In the last crash, we saw everything drop in price.

S&P 500 dropped 50%.

Real estate prices dropped at least a third.

As people had less money to spend, the prices of everything went down.

Except for rent of primary residence.

Here’s a graph of Consumer Price Index for All Urban Consumers since the 1950s.

Rent is always higher than paying expenses and mortgage on our real estate.

Prepare for changes in economic conditions

When I bought my home in 2006, I looked at the highest European Central Banks interest rates. I asked myself, “Would I be able to pay the monthly payments when interest rates would be that high?”

Maybe you are a little less risk averse, but calculate what would happen to your mortgage payments if the interest rate doubles.

Would you still be able to pay?

Right now the interest rates are at an all-time low, but what happens if they get back to 3, 4, or even 5 percent level. And the interest rates may stay low, but the bank can still screw you.

The emotional value of a home

Some people find it hard not to get sentimental about their home.

My mother lived in her apartment for more than 55 years. My grandfather helped with a down payment, and she started to make the payments form the very first job she had. That was uncommon in the Soviet Union. That small apartment was one of the cornerstones of her life, but she would have sold it if needed.

Every asset you have has a value, and in the case of emergency, it’s a tool that gets you out of a tight spot.

Remember that when you lose your income, then immediately start thinking about the sale of your home. It’s a long process, and you have to be prepared.

Owning your home is a great idea!

You may want to make up your mind by calculating the potential return of different asset classes. Do not let anyone tell you that owning a home is not an investment.

It’s like buying a case of good wine. You can be pretty sure that the value will go up for some time. However, the wine bottle will not give you a monthly check, and you realize your profit at the end.

The best investment on earth is earth. ~ Louis Glickman

Over to you

From the above, you can see that I’m a big fan of owning a home and seeing it as an investment.

What do you think?

Did I miss something that would make a home less attractive investment.

_____________________

Photo by Milly Eaton from Pexels

![Read more about the article Making Realistic New Year’s Resolutions [in 2024]](https://fixwillpower.com/wp-content/uploads/new-years-resolutions-429x314.jpg)

![Read more about the article How to Survive the Economic Crisis [of 2024]?](https://fixwillpower.com/wp-content/uploads/survive-economic-crisis-429x314.jpg)

![Read more about the article Tiered Personal Emergency Fund to Make You Bulletproof [in 2024]](https://fixwillpower.com/wp-content/uploads/personal-emergency-funds-429x314.jpg)

Love the fresh angle, totally agree!

Thank, Jaan!