Do you want to survive the economic crisis and come out from the other side as strong as possible?

As I write this, we have hit a bit of a rough patch in the economy due to the coronavirus outbreak.

The following is not financial advice. Just something I consider when the economy is not going in the right direction.

Here are the steps I used in the last downturn and follow now. For you and your business:

Europe, where I live, is in chaos and lockdown:

- All travel is cancelled,

- borders are closed,

- people are quarantined.

Globally the financial markets have crashed about one third. S&P 500 hit almost 3400 in February, and now, a month later, it briefly dipped below 2200. Seems that the economic collapse 2020 will be a big one.

I have the unfortunate skill of buying at the very peak. Also, this time I loaded up on Facebook stock just before everything collapsed.

It all hit the fan around the beginning of March. Before March it was something that happened in China. Eventually the first world noticed that it will hit us all.

When will the crisis be over?

How long is this crisis going to last?

Nobody knows.

The optimist in me says that the virus outbreak could be over as soon as in the middle of the summer.

The worst-case scenario is that the new coronavirus will stay with us like the flu. It never goes away and hits us every year. More on some years, less on the others.

Even if the virus situation goes away, the fallout from the disruption in business will still cause a recession.

How long will the crisis affect us?

Nobody knows.

In the best-case scenario, we are looking at months for the virus to subside. And then 6 months to a year for the economy to recover.

So, in the best-case scenario, you have at least a year of bumpy road ahead.

How do you come out from the other side with least amount of problems? Here’s an economic collapse preparation list you can follow:

Crisis and deadlocks when they occur have at least this advantage, they force us to think. ~ Jawaharlal Nehru

Mandatory spending

Mandatory spending is everything you have to pay to meet the basic need. Roof over your head. Food on the table. Everything else you need to survive.

Food is the only thing you really can’t stop consuming. Everything else is optional.

Shelter seems like something you have to have. Some people get by without having a place to live. But even they have a place to live, even if that is an abandoned building or car.

Phone with an internet connection. If you want to be a part of the modern society, then you have to use online services like banking. It would make your life incredibly inconvenient when you don’t have access to internet.

Budgeting tool

Get a budgeting tool and track your spending. Or better yet, take the last two months of your bank statements and find the items you can cut.

To survive an economic crisis, cut to the bone.

Create a simple spending plan and track your income and expenses.

Streaming services, music, mobile, internet. Cut everything you can. You can read more about stop watching TV here. But you still need some communications and entertainment.

Keep some services but downgrade them to a lower tier offer.

Eating out? Ordering in?

Not anymore!

Buy all the foodstuff from the grocery store and make your own meals. If you go to the office, put the leftovers in the box and that will be your lunch.

Car leasing and commute

Can you live without a car? Can you commute using mostly public transportation and Uber when you are in a hurry?

The important number is your car’s total cost of ownership. Leasing, fuel, parking, insurance, and maintenance add up.

If you think you can get by without a car, return the car to the leasing company. The problem with leasing is that when can’t pay you will get penalties and interests on top of your actual debt.

When you think about your expanses without a car, then add up public transportation, taxis, and Ubers. You also have to factor in the time you waste using public transportation. Let’s say you make 30 dollars per hour. Wasting an hour every day on transit will cost you at least 500 dollars per month.

If you can, go extremely cheap. You can buy a decent used car for the price of 6 to 10 monthly leasing payments. But you have to have the money to buy it.

And no, these cars do not fall apart after you buy them.

The least you can do is find out what are your total monthly expenses on transportation. Also, read your leasing agreement to find out how you can return the car with least amount of penalties.

Mortgage payments

Owning a home is a great investment! But in the case of economic downturn, your monthly payments can become an unbearable burden. Let’s see what the options are:

Tough it out in the case where your income declines but you can still make the mortgage payments. Keeping your home is almost always a great investment.

Sell your home.

There might be the case that you can sell your home near the lever you bought it and after that the market keeps declining. You can buy a new home when the market starts to recover.

The problem with not owing your home is that all the rent payments are an expense. At the same time big part of mortgage payments goes into your net worth as the share of the home already paid up.

More about that later.

Rent a cheaper home

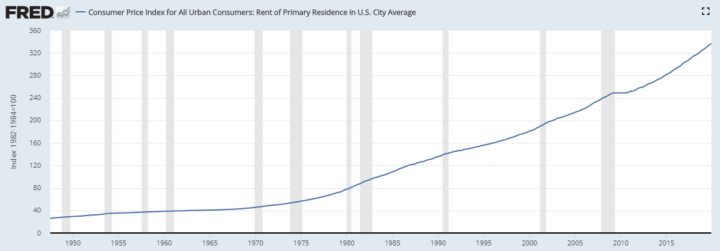

Rents drop little during downturn.

Rent out your home and get a rental that costs less than you get for your home. An interesting thing about the rental market is that it stays relatively stable in economic downturns. Rents won’t go up, but they wound go down either.

This means you could rent your home and rent yourself a smaller place that gives you some extra money.

Whatever your decision concerning your home, ask for better terms on the loan. Banks usually do not what to own homes. If you show them, you will not default but need better terms, then you just might get it.

There are some financial aspects you should consider. When you can see that the recession is coming you could try to sell your home before total economic collapse. Later you can buy another home for a lower price when the economy starts to recover.

Meanwhile, you have to rent. Rent money is lost to you.

Calculate the number from declining home price versus the rent you have to pay if you sell.

- Your monthly mortgage and other expenses

- How much rent can you get

- How much you have to pay for renting a smaller home

Credit card debt

If you have credit card debt, then do everything you can to eliminate it. The interest on those debts is horrendous. All the interest you can eliminate is money saved.

Make this the year you tackle that credit card debt once and for all. ~ Suze Orman

Salary

Often the first thing businesses cut in uncertain times is the salaries. Think what happens if your salary drops by 30%. Therefore, you need to list all your expenses and cut everything that’s not essential.

Cancel subscriptions

Netflix, Spotify, mobile, internet connection. Cut everything you can. Here you can read about how to give up TV, but you don’t have to give it up completely. Make sure you don’t have multiple similar services.

After you have left with one of everything you need, downgrade to lower tier offering.

Monthly fees

If you have any services that have monthly fees, make a list and cut everything you can.

Gym membership

Cancel it! During the economic crisis, go for cheap sports where you don’t have to pay to participate. Running is probably the cheapest. Cycling also doesn’t require payments as long as you already have the gear.

The absolutely simplest thing you can do is go for a walk every day.

All truly great thoughts are conceived while walking. ~ Friedrich Nietzsche

Simple food and eating out

Don’t eat out!

You don’t order in!

Get the raw materials from the grocery store and make simple healthy dishes at home. It is unbelievable how low you can go with your grocery budget as long as you just eat what you need.

Prepare food at home to take to work or on a trip. Don’t waste any food and the leftover the next day.

Renegotiate everything

Ask for a break in paying the principal on our mortgage. Renegotiate your leasing payments, credit card terms and everything else where you have a contract.

Even if you feel that you are in no position to make demands. Remember, they don’t know that. Economic downturn creates problems for them too. You can tell them you are considering switching providers and what terms can they offer you in that situation.

When renegotiating your deals make sure you know how to negotiate. THE best book about negotiation is Never Spilt the Difference by Chris Voss. Read that book or listen to the audiobook, you will become a much better negotiator.

Ask for what you want, and you will get it more often than you think.

Everything is negotiable. Whether or not the negotiation is easy is another thing. ~ Carrie Fisher

Postpone all non-essential expenses

Maybe I left something out. Analyze your expenses over the last couple of months. Ask yourself:

Which expenses are recurring?

What can you eliminate?

Cut everything you can!

Cut even if it the saving is small. For example, I have a 200Mbps internet connection. It’s a luxury. If I downgrade it to 100Mbps then I would save 8 euros. Doesn’t seem like much, but over the year it’s 100 euros. I could downgrade even further and save almost 200 euros per year.

Find all the items where small changes save a bit of money and you could save thousands per year.

Save all the money you save

Implementing all the changes, you may cut hundreds of dollars from your monthly expenses.

Save all the money.

The money you save will create or bolster your emergency fund.

Because you may need it.

Unemployment

What happens if you lose your job? I hope you have an emergency fund, but more than 50% of Americans have less than 1000 dollars in reserves.

What is your reality?

Who can you turn to when the worst-case scenario happens, and you don’t have any income?

Talk to your spouse, your parents and friends about how to get by when you don’t have a job anymore.

The hardest work in the world is being out of work. ~ Whitney M. Young

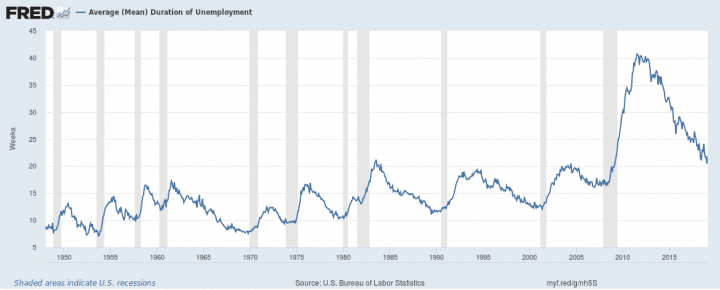

According to FRED data, the average time people are unemployed in the United States is 25 weeks.

Sell your stuff to survive economic crisis

First thing you can do is sell everything. Sell everything you can live without.

Better do it sooner than later. The best idea is to sell all your crap before you lose your job.

The earlier you sell, the lower is the competition with other people who have lost their jobs.

Maybe you could sell our jewelry for thousands now, but you will get only half that when the situation gets worse.

Some people have a lot of useless stuff in a storage locker.

For example, when I moved out of my office, I put everything we had in storage. I didn’t need it, but I felt attached to it. I paid thousands of dollars for having a place for useless stuff.

Finally, I gave everything to friends and charity.

Sell it! Give it away! Now! And stop paying for the storage locker. It’s like a tax.

Sell your home

Your home should be the last thing you sell.

Or the first.

If you want to save your home at all cost, then sell it as a last resort. You will lose 10, 20, maybe 40 percent of the price.

If you think the situation will get really bad, then sell your home immediately.

Selling earlier will cut your losses. But you can never time the market, and you could sell at the bottom. Calculate the worst-casee scenario:

- What will happen if this is the bottom and the worst time to sell.

- What’ll happen if things get worse and you don’t sell.

These are hard decisions to make and depend completely on your situation and outlook.

Side job and learn new skills

Do you have any marketable skills?

Go to sites like Fiverr.com and Odesk and offer your services.

Price your services low.

At this point you want experience not money.

For example, I get a lot of my income from live seminars and workshops. For now, all these are over. The obvious solution is to move the events online. However, the whole reason for live in-person training sessions is better connection with the participants.

I will release my first recorded workshop in a few months. I’m anxious about how well it will perform. But if you don’t try new things, then nothing will improve.

Packaging what you know

Think about the skills you have. Can you monetize them online? There are many options with their pros and cons.

Online training – record something and sell it online to many people. Maybe dozens, hundreds, or even thousands. You can use sites like Udemy.

Webinar – create a live event where you present information for an hour or two. You can use Facebook live or other freely available tools for that.

Coaching and consulting – one-on-one sessions with clients. You can help them solve their problems in your area of expertize. Charge by the hour. You can use simple tools like Skype, Zoom, or Messenger.

Sell services online that you work on by yourself and deliver the results later.

I focused on these examples because they don’t require you to have anything else than an internet connection and a decent microphone.

For many people this is just business as usual. For them, the competition will get tougher as more people flood the online space offering services.

Small business owners

I will talk about two types of businesses. In one case, you have to take care of your employees.

In the other, it’s just you.

Some things you have to do to survive an economic crisis are the same for both. However, managing other people adds a lot of complexity.

Current monetary reserves

If your business has accumulated profits, now is the time to decide what to do with that money.

Do you want to burn the reserves by trying to keep the business afloat? Should you pay out any reserves as dividend and streamline the business to survive on the revenue it can generate to survive an economic crisis?

Your decision also depends on the capital structure and the relationships you have with the other shareholders.

Any action you take that is leaning towards shareholders can have significant fallout among ordinary workers. Take advantage of all the stimulus packages to help make payments and keep workers on your payroll.

If it’s just you, your friends or family, then pay out the money. You can later decide to put it back in. However, if you leave it in it will burn.

Talk to your employees

First, let’s look at the businesses where you have other people working for you.

You have employees.

They do not have any idea where money comes from.

Explain to them clearly, how much revenue you have to make each month to keep the lights on.

Make it as transparent as possible.

Let each member of the team see what their part is in the plan to survive the economic crisis.

Help your employees come up with the ideas of what they can do in the case you have to let them go. Do that before you even plan to let go anybody.

If you start to fall behind in your plan. Let people know early that problems are coming. Ask for help. Explain what needs to happen to turn the situation around.

When you do all that, you soften the blows that come later.

You may have to let people go. Or you could lower the salaries for everyone and avoid letting people go.

One of my business partners gave the choice to the team. We have to cut payroll expenses by 30%. Do you want us to fire 30% of you or everybody gets a 30% salary cut.

When you cut salaries, cut management salaries more. Cut your own too. Of course, it works only if your salary is public.

I hope it doesn’t come to that for you, but it will for most businesses.

Talk to your subcontractors

Your subcontractors are like your employees. Let them know what’s happening.

Ask for help. Ask for discounts. When they sell to you at a discount, they can keep their businesses running. When you go out of business, they will get nothing from you.

Talk to your customers

Now is the time to use the social capital you have accumulated with your customers over the years.

Ask for more business. Ask for a renewal of contracts. You may give discounts and better terms in return, but having a customer and staying in business is always better than the alternative.

Remote work

The coronavirus forced people into social distancing and isolation. This natural experiment will change the commercial real estate market for years to come.

Use that!

Ask for lower rent. Rent payments are now more negotiable than ever before. After the crisis is over, there will be less need for office space than there was before March 2020. This trend will not change, and landlords have to adjust their practices.

Move to a smaller rental space. I read somewhere that there are about 30% of jobs you can do remotely. This still leaves a lot of need for commercial spaces. Shops, factories, hairdressers, and other businesses will still need space. But you can make some work remote and save on the type and size of the space you need.

Cut cost

As with your personal finances, cut cost to the bone.

You can’t grow your business by cutting cost, but you can save it.

In the last crisis, I thought I could find the clients who still buy and sell them enough to maintain the current expenses.

Nope!

Some projects stalled. The others were canceled. And in the end, I went almost bankrupt.

It’s hard. I thought if I let that person go, then I can’t sell the services she offers. As I failed at sales, I had to let the person go anyway, but I had also accumulated massive debt.

We had a huge pile of cash in the bank before the last crisis, and we burned through all of it.

We also got into debt on top of that.

It all could have been avoided if I would have started to cut cost early.

Cutting cost is under your control.

You can always revers the cost-cutting actions.

But if you don’t cut the cost and the money is gone, nothing will bing it back.

Surviving economic crisis in a nut shell

For you, as a person or a business owner, the key to getting through to the other side, is having enough resources to weather the storm.

It’s always easier to spend money than make it back.

Make hard decisions early or they will be made for you later.

Cut every cost!

Change for cheaper options of everything you use.

Get everything out of every income source.

I hope you will use some ideas above to lessen the impact of the economic situation.

Hopefully, well get through the 2020 virus situation as fast as possible.

Even if you happen to read this when everything is fine then use the tips in this post to make yourself bulletproof against next crisis.

![Read more about the article Making Realistic New Year’s Resolutions [in 2024]](https://fixwillpower.com/wp-content/uploads/new-years-resolutions-429x314.jpg)

![Read more about the article Tiered Personal Emergency Fund to Make You Bulletproof [in 2025]](https://fixwillpower.com/wp-content/uploads/personal-emergency-funds-429x314.jpg)

![Read more about the article Your Home is a Great Real Estate Investment [VIDEO]](https://fixwillpower.com/wp-content/uploads/home-real-estate-investment-429x314.jpg)