Some crisis comes slowly, others overnight.

Personal financial emergency fund keeps you afloat when something happens.

What happens when you lose your income for 6 months?

You need to secure enough personal financial emergency funds to get through negative events in your life.

Always save something for a rainy day. The average American does not have 500 dollars in a personal emergency fund. If the car breaks down or they need money for some other emergency, they do not have it.

Over 50% of Americans do not have enough in their personal financial emergency fund.

Don’t be one of them!

Let’s look at what reserves you need.

Even if you are doing well financially, have a backup plan for when something goes wrong. Next, I will give you an overview of how to start an emergency fund.

Surviving the economic crisis

Do you want to survive the economic crisis and come out from the other side as strong as possible? Here are the steps I used in the last downturn and follow now.

How big personal emergency fund do you need?

You need at least 6 to 8-month emergency fund to cover expenses, stored in an easy to access place.

Why half a year or even more?

When you get fired, or your business hits a rough patch, then you need at least 6 months’ income to deal with the situation. The time to find another job or turn around your business depends on the state of the economy. When the economy turns down, it’s harder to fix your situation. And it’s more likely to have financial problems in an economic downturn.

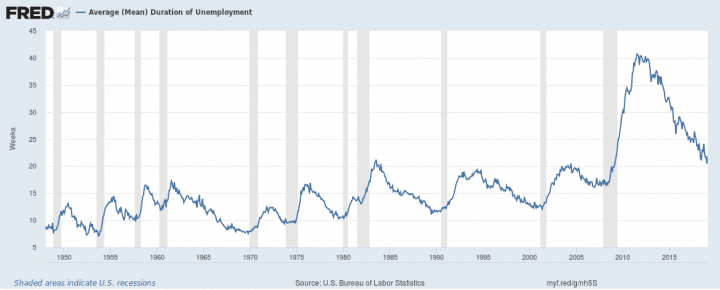

According to FRED data, the average time people are unemployed in the United States is 25 weeks.

You need your personal emergency fund to last through that period. If you are cautious like me, then you might want to stretch that to 9 months. During the aftermath of the 2007 and 2008 financial crisis, the average unemployment time was around the 40-week mark.

In some other countries, the unemployment period may be a lot longer. A year, 18 months, or even more. Find out what’s the number in your country or industry and prepare yourself.

What types of financial reserves do you need?

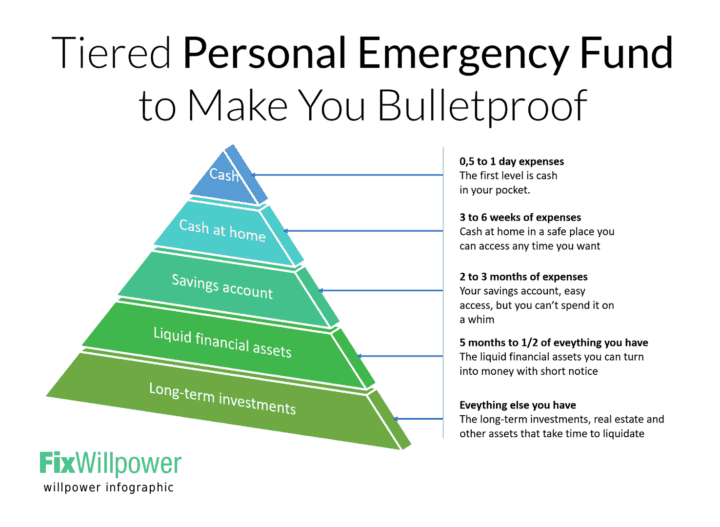

1. The first level is just cash in your pocket.

2. Next, you would need some cash at home or another safe place that you can access any time you want.

3. Then there’s your savings account that is relatively easy to access, but you can’t spend it on a whim.

4. After that come the liquid financial assets like stock positions and other instruments you can turn into money with short notice.

5. And then there are the long-term investments in real estate and other assets that take a long time to liquidate.

What is your current situation?

You could be in one of these three situations:

1. You spend more than you earn.

The people in the first group should start cutting back on spending.

Now!

The other option is to increase your income, but that may take more time.

The next step would be to get yourself out of the hole you have dug for yourself. Stop the debt from growing. However, have a month worth of income available in your emergency fund even you are in debt.

2. You live paycheck to paycheck and spend all the money you earn.

The people in the second group should start saving right now. When you get your next salary, put aside 1%. 5 or 10% if you can. Again, you must have an emergency reserve of about one month’s income to cover smaller, unexpected emergencies. Next, eliminate all debt that has an interest rate of more than 10% per year.

3. You earn more than you spend and save some money you earn every month.

If for every 3,000 dollars you earn, you only spend 1,500 then use that for calculating what you need in your fund.

Just check that you don’t have any debt with interest rates above 10%. If you do, paying those off is the best investment you can make.

Now let’s look at each of these classes of emergency funds.

Emergency fund is an airbag against the accidents that happen in economy. ~ Priit Kallas

Cash in pocket

Cash on you – always have cash on you.

Most people pay by credit card.

Sometimes, it’s not be possible. Carry enough money on you so you can pay cash if you have to.

How much money should you have on you?

It depends on your financial situation and where you are. Usually, carrying half days’ worth of expenses is enough. When you are traveling, carry more money. Maybe one day’s expenses.

When to use it?

- There’s a shop that doesn’t accept your card.

- The electronic payment doesn’t work.

- Merchants at the market.

- Tip at the restaurant.

In all locations where cash is a preferred payment method, use your pocket money emergency fund. Sometimes you can even get a discount for paying cash.

Make sure you replace your pocket cash later, so you always have it.

When to increase the amount of money you carry?

Your pocket money should match your average expenses. I would carry a bit more when traveling.

Security: keep that money separate from your credit cards. When you lose your wallet, you still have the cash. Use a money belt when traveling. Never leave our money in the car or otherwise unattended.

Pay off your credit card bills in full at the end of each month and set aside money toward your emergency savings. ~ Suze Orman

Cash at home

Cash in a safe place – store some money in a safe place where you can easily access it.

How much money should you have at home?

The sum could be anywhere from a week to 4 weeks of income. This money usually just sits there, and you rarely use it. But whenever something happens with the electronic payment system, or you need a larger amount of cash immediately, then you can dig into this cache.

When to use it?

When you unexpectedly need money to pay cash for a larger purchase. When you go traveling, convert your emergency fund to the local currency. Always replace the money after you have taken care of the situation where you needed cash.

When to increase it?

Whenever your income increases, increase your cash reserve. However, there’s a reasonable limit to your cash emergency fund. Your monthly income.

Security: you store that money at home in a place you can be reasonably sure no one will find it when searching in a hurry. It doesn’t have to be in the safe, but it should not be visible either. If other people have access to your home without you being there, then make sure you lock your money away.

Fireproof safe might be a prudent choice, as one emergency situation that may happen is a home fire.

Never spend your money before you have earned it. ~ Thomas Jefferson

Savings account

Before you continue, eliminate student loan, credit card debt, or any other high-interest loans you may have.

Bank account – bank account is your main emergency savings fund. Create a separate account tied to your credit card payments. Preferably in a different bank.

How much money should you have in your savings account?

I would keep a balance of 2 to 3 month’s income on that account and never touch it. As your income and expenses increase, add more money to that account. Don’t take money out of that account when your income drops. If your income drops, then the safety account will just have more multiples of your income on it.

The main reason you don’t want to keep more money in that account is the inflation will nibble away at it. So, the amount should be as low as possible to make you feel safe. Maybe 2 months is a minimum.

When to use it?

The safety account is the personal emergency fund that you use when you lose your income. Pay your rent and bills, buy food and gas. Transfer small amounts of money from a safety account to your general account when you need it.

Never transfer all the money to your checking account.

When to increase the emergency fund amount?

Every time you get an unexpected income, put some of your new money into this account.

When your regular income increases, put money into the account to match at least 3 months of income.

You can go as high as 6 or 9 months’ income in this account, but after that, start thinking about investing in liquid financial assets.

Security: the main risk, in this case, is the financial meltdown. Many countries have bank laws that protect a private person’s savings up to certain sum. Getting your money back in this way takes time. The key here is that you have access to the money when you need it. Split this money to separate banks and make sure something is left if one bank fails.

Liquid financial instruments

Cash and bank account just sit there and lose your money to inflation, but you must have this personal financial emergency fund for quick access.

Now we get to the financial investment that will make you money. Well, sometimes it will lose your money. The easiest and cheapest investment would be an index fund. Then there’s:

- stocks,

- bonds,

- mutual funds,

- precious metals,

and other instruments that you can turn into cold hard cash in a few days or weeks.

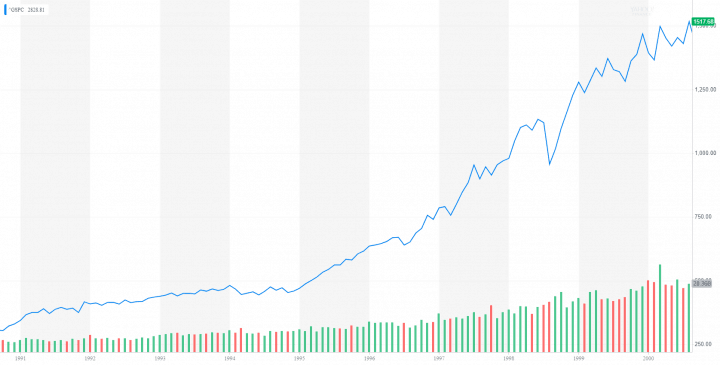

Here’s what you can make when you hit fair weather. During the long boom of 1990 to 2000, the stock market index grew by almost 400 percent.

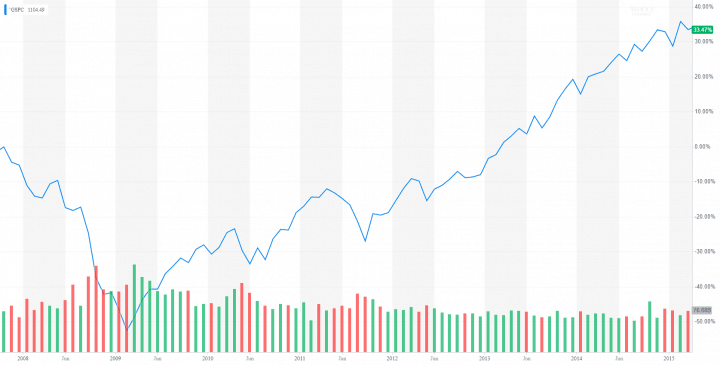

And this is your money when you invest before a major crash. When you started investing just before the last crash, then you needed more than 5 years to break even.

Of course, most people freaked out and liquidated their positions at the most inconvenient price point.

With added inflation, you have lost almost a full decade of growth.

On average, you could expect a 6 to 7 percent return on your financial investments over the longer periods like 10 years and more.

You can fiddle around with the S&P 500 index here.

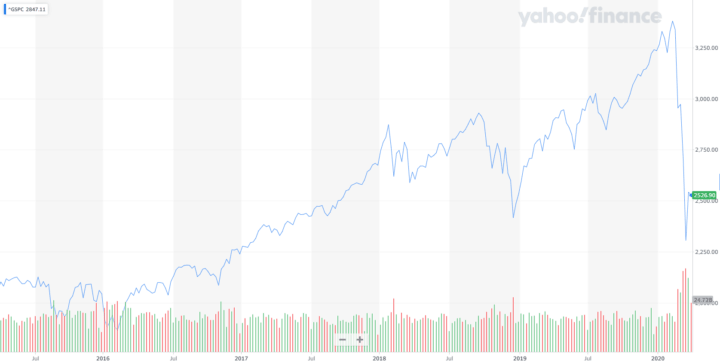

Oh, and this happened during the corona virus crash.

How much money to put into financial investments?

Now things get complicated.

You should invest your money into different uncorrelated asset classes so when stocks crash, your other investments are not wiped out simultaneously. In the end, you will decide that some percentage of your investable resources will go into stocks and other liquid assets.

When to use it?

Hopefully, you will never get into trouble that deep.

Burn through your cash emergency fund before you liquidate your stock positions. Having cash reserves and a bank account means that you have at least several months to get yourself out of the trouble.

But don’t worry, personal emergency funds are meant to help you recover up to a year after losing income.

When to increase the amount of investment?

In time, you will end up having several years’ worth of assets in this personal financial fund. And it will keep growing proportional to the increase in your net worth.

Security: there’s not much to worry about when you invest in financial markets. It’s like the money in the bank, but you don’t have any protection if the business you invest in goes bankrupt.

Enron!

The problem with the stock positions is the economic downturn, fraud, and 10 other things.

You get some protection against specific companies going belly up by investing in a low-cost index fund tracking S&P500 or other indexes.

When the s**t really hits the economic fan, then your stocks (and index fund) will take a hit. If you happily thought you have a personal emergency fund worth 12 months of income on your brokerage account, it may come as a shock when you see 20 to 30 percent evaporate in a few months or even days.

Consumer staples and healthcare seem to be the best stocks to get through a crisis. Both sectors lost the least in the dotcom and 2007 meltdowns. If you want to invest in stocks use AI to give you a second opinion.

Oh, well… life is risk.

Non-liquid assets

Long-term investments in assets that you can’t easily liquidate.

Now we get to all the other investments you can make that are not as liquid as described before:

- real estate,

- long-term loans,

- art,

- wine,

and other investments where you put your money in, and it takes months or years to get it out.

Everything you have over the personal financial emergency fund described above can go into safer long-term investments. Diversify your portfolio and use common sense to avoid stupid mistakes.

Important note on investing in a home

I want to explain that investing in home real estate is investing!

I see a lot of finance guys saying that home is not an investment. Yes, I get it you don’t get rent checks, but you still get value.

If I buy a home, let’s say 500k no down payment and 4% interest for 20 years. Then I pay 727k to the bank and own the home. My monthly payments would be around 3k.

Homes appreciate about 6% a year, so in 20 years, my home will be worth 1.6 million.

Plus, I have lived in a 500k house rent-free for 20 years. Let’s say that’s a 2k win over renting. Savings from rent total 480k. Looking it another way every month, you get the 2000-dollar rent payment that you use to pay your rent, which is also 2000.

You have to live somewhere.

Your total net worth after 20 years, if you started from zero, would be:

1.6M + 480k – 727k = 1.35 million

over the rent option.

I’m doing it right now. The idea works as long as the interest on the bank loan is low enough.

And yes, I know, I didn’t consider inflation. There are other expenses tied to owning, insurance, taxes, etc. but you will still come out ahead.

Read more about how your home is a real estate investment.

Do not leave yourself or your family unprotected against financial storms… Build up savings. ~ Ezra Taft Benson

Very high income and high savings rate

For most people, I suggest calculating the personal emergency fund based on their income. For those who make a ton of money, the numbers may be a bit different. Or rather, you have two options:

A: You can use the same formula as described above if you make 70k per month. You would have a 30000 emergency fund or even 70 thousand dollars at home and an easily accessible bank account with at least 200 thousand dollars on it. This way, you have a high probability of continuing your lifestyle when you hit the rough patch.

B: The second option to determine emergency fund size is on your country’s average income levels. You could base your reserves on a double or triple of a good income. You still have all your money in financial and long-term investments, but lower emergency reserves make you scale down your spending in the time of crisis.

Lower spending, in turn, gives you a lot longer runway. And, of course, when you scale down your spending, you’ll feel the need to get back up and do something about the situation.

The pain in the butt that will motivate you to act.

Health emergency fund is insurance

Now let’s talk about the biggest risk you have.

Health risks are the one thing against which most of the population is helpless — health problems in the family.

If you have a big health problem, then it will wipe you out.

The medical bills can go into hundreds of thousands and even millions.

You must have medical insurance!

Medical insurance is especially important in the US, where there’s no social safety net. But in many other countries, your medical insurance may not cover rare diseases or special cases.

The way to build your savings is by spending less each month. ~ Suze Orman

What is not an asset

When you calculate your net worth, only consider the assets that are relatively easy to convert to money. Liquid means that you should leave out most of the stuff you own.

Car – decreases in value. You need to drop the price if you want to sell it fast.

The business you run – the business seems many times more valuable to you than it does to the outsider. Small business is hard to sell, and you will probably not get what you want for it.

Things you own – clothes, furniture, gadgets, and other items you use daily. When you are doing a garage sale, you will get pennies on a dollar. If it’s something you use, keep it, because replacing it later will take many times more money than you get from the used item.

The money you invested in your friend’s new startup – when you invest in your friend’s business, consider that money lost.

Yes, all these items have value.

When you are in over your head, then, of course, sell what you can, and this may be a lifeline that keeps you afloat. But never consider these items as part of your assets.

Want to buy my underwear for a dollar?

You deserve to have the peace of mind

After you create your cash reserves, you will have a different outlook on your life and choices.

You feel more confident, and the future is wide open. It’s not the “fuck you” money in the sense that you don’t have to work ever again. But you will have a backup for a rainy day or month or a year.

Personal emergency fund while traveling

Yes, have access to your finances, even on the mountaintop in the Alps.

When you go for a trip, that’s longer than a couple of days, then you should make sure you have access to all your financial reserves.

Credit cards and debit cards

Check the dates on the cards. You may have thousands in the bank, but it’s useless if you can’t access it. You don’t want to find out you can’t access your money when you have to pay at the restaurant in the middle of the night.

Online banking login info and card PINs

My friend was renting a car in Milan airport and wanted to use the card he had used for booking. He hadn’t used that card for a while and didn’t remember the PIN.

No PIN, no car.

My other friend had to go to the emergency room after her kid fell while snowboarding.

She had insurance. But she had to pay for the procedures on site.

Again, she didn’t remember the PIN of the card that had enough funds for the medical bill.

I had to transfer money to her other card so she could take care of the bill.

Luckily, we had accounts in the same bank, and the transfer was instantaneous.

Luckily, I had mobile banking on my phone and could make the transaction on the mountain while snowboarding.

When you travel, a lot can happen, make sure you are ready!

Before you leave your country, check if you remember all the login information and PINs for your cards.

I mean, physically check it!

Put the card in the ATM and enter the PIN. Open your computer and log in to various financial services that you use.

You may also want to test your online financial services with different devices. Maybe there are problems with the mobile interface, or you need an app to use the service on your phone.

After you have made sure everything works, you are ready to go.

Access to your other funds

Next, you should also have access to funds you have invested in the long term.

Sure, you probably can’t sell your real estate while traveling. However, have access to your online brokering account.

As with bank accounts and credit cards, make sure you have the login information with you. Before you leave, test the systems on computers and mobiles. If everything works, then you are good to go.

Chance favors only the prepared mind. ~ Louis Pasteur

Be prepared!

Above, I gave you an overview of emergency fund examples on how to secure your finances.

Please do that!

Lessen your mental load spent on worrying!

You will be more productive. You will be happier. You will be safe and can focus on the most important things in your life.

It’s incredibly liberating to know I don’t have to worry even if the corona virus lockdown lasts for a year.

For many people, the personal financial emergency fund may take years to build.

The best time to start was several years ago.

The next best time to start is NOW.

_______________________________

Image credit Reimund Bertrams

Airbag image

![Read more about the article How to Give Yourself Credit [and Why It Matters]](https://fixwillpower.com/wp-content/uploads/give-yourself-credit-429x314.jpg)

![Read more about the article Making Realistic New Year’s Resolutions [in 2024]](https://fixwillpower.com/wp-content/uploads/new-years-resolutions-429x314.jpg)

![Read more about the article Procrastination Quotes that Inspire You to Act [NOW!]](https://fixwillpower.com/wp-content/uploads/procrastination-quotes-429x314.jpg)

![Read more about the article Why You Should Find the Good in a Bad Situation [4 STEPS]](https://fixwillpower.com/wp-content/uploads/interested-surprise-429x314.jpg)

Excellent article! Emergency funds are such an important foundation for financial security. I was surprised when you said 9 months, but considering average unemployment time that makes sense.

Another tip – for cash at home I keep in very small denominations lots of $1, $5 etc. just in case there’s a rolling blackout or a zombie attack and no one can break change.

Thank you for your comment! The small denomination tip is great!